Speed

Accuracy

Quality

What is a Residential Appraisal?

A residential appraisal is the process of determining the market value of a residential property. The primary purpose of a residential appraisal is to provide an unbiased and professional estimate of the property’s value, usually conducted by a licensed or certified appraiser. This valuation is crucial in various real estate-related scenarios.

In essence, residential appraisals provide an objective and professional opinion on a property’s value, offering crucial information for various stakeholders involved in real estate transactions and financial decisions. The appraisal process involves a thorough analysis of the property, considering its condition, location, features, and comparable sales in the surrounding area.

Reasons why you may need an appraisal

Real Estate Transactions

During the sale or purchase of a residential property, an appraisal helps both buyers and sellers establish a fair and reasonable price for the property. Lenders often require an appraisal before approving a mortgage to ensure that the loan amount aligns with the property’s market value.

Mortgage Financing

Refinancing

Home Equity Loans and Lines of Credit:

PMI Removal

Estate Planning and Settlement

Insurance Purposes

Property Tax Assessment

Litigation and Disputes

Home Improvement Planning

Get Your Home Appraised in 3 easy steps

Step 1. Schedule with Davlin Appraisal

You can call me or use the contact page to get your appraisal started.

Step 2. Provide Requested Property Info

Want to know more about the general steps involved in a residential appraisal?

Click Learn More below to find out.

Step 3. Receive Your Appraisal

Appraisals can be confusing. There are some common factors that affect most appraisals.

Click below to get those explained.

About Us

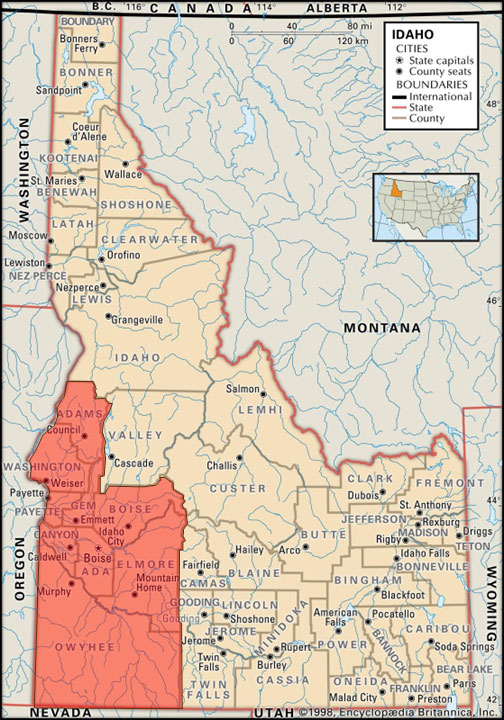

Service Areas

- ADA COUNTY

- ADAMS COUNTY

- BOISE COUNTY

- CANYON COUNTY

- GEM COUNTY

- ELMORE COUNTY

- OWYHEE COUNTY

- PAYETTE COUNTY

- WASHINGTON COUNTY

ADA COUNTY

ADAMS COUNTY

BOISE COUNTY

CANYON COUNTY

GEM COUNTY

OWYHEE COUNTY

ELMORE COUNTY

PAYETTE COUNTY

WASHINGTON COUNTY